Microstrategy Launches Bitcoin-Based Identity Solution, "Orange"

Microstrategy Orange uses the Bitcoin blockchain to create and manage pseudonymous digital identities.

Bitcoin's 'halving' events, intrinsic to its decentralized, blockchain-based model, effectively control its supply and can potentially influence price growth.

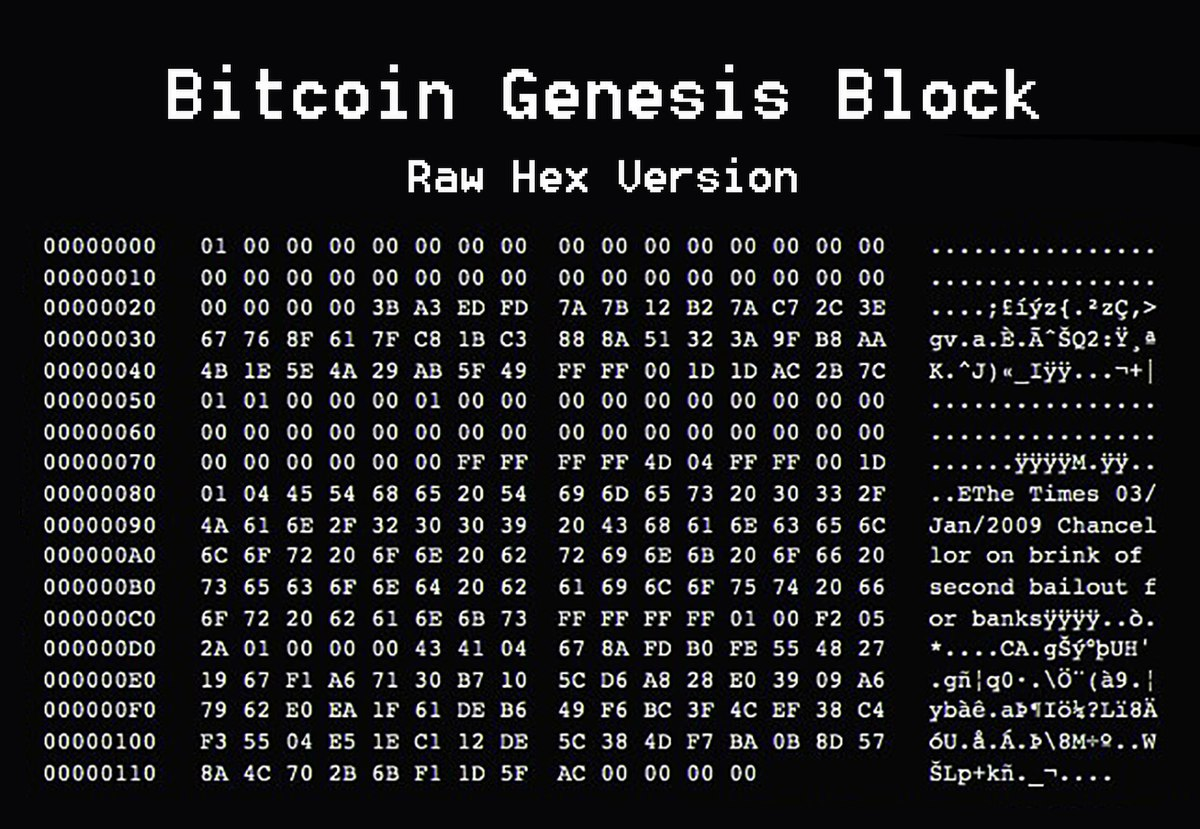

Born from the vision of the elusive figure known as Satoshi Nakamoto, Bitcoin emerged in 2009 as a ground-breaking alternative to traditional monetary systems. It responded to the global financial crisis of 2008 with a promise of decentralization, untethered from governmental influence, and thus opened a new era of digital currencies.

Powering Bitcoin is the revolutionary technology known as the blockchain, a kind of distributed ledger that stores transaction data across a vast network of computers around the world. Each transaction forms a data block, and these blocks are strung together chronologically using cryptography, creating the metaphorical "block chain". This architecture ensures an unprecedented level of transparency and security—tampering with data within a block requires consensus across the network, which practically nullifies fraudulent activities.

Bitcoin is renowned for its decentralization. There's no central authority or bank governing Bitcoin. Instead, a network of computers, known as nodes, verify transactions through a series of complex calculations, a process called mining. This mechanism is vital in maintaining the integrity and security of the Bitcoin network.

Notably, Bitcoin comes with built-in scarcity. The total Bitcoin count that will ever exist is limited to 21 million. This scarcity, programmed into the Bitcoin protocol, presents a stark contrast to traditional fiat currencies, which can be (and are) freely inflated by central banks.

Bitcoin mining involves high-powered computers that execute complex mathematical calculations, a system referred to as Proof of Work. On solving a problem, the miner incorporates a new block of transactions into the Bitcoin blockchain, which serves as a ledger for recent transactions within the network.

Miners essentially guess a specific number. The Bitcoin network sets a target number, and miners guess another number that, combined with the block data and hashed, results in a value lesser than the target. The guessing process involves modifying a piece of block data, the nonce, and evaluating the resulting hash. This process, computationally intensive, requires significant power and energy.

The first successful miner gets the privilege of adding the new block to the blockchain and is rewarded with newly created bitcoins as a block reward. The current block reward is 6.25 BTC (originally 50 BTC). This reward is halved approximately every four years in an event known as "halving." Halving events occur every 210,000 blocks, leading to a final Bitcoin supply of 21 million by around 2140. Post that, miners will be compensated solely by transaction fees.

| Event | Date | Block Number | Reward |

|---|---|---|---|

| Launch of Bitcoin | 3 Jan. 2009 | 0 | 50 BTC |

| 1st halving | 28 Nov. 2012 | 210,000 | 25 BTC |

| 2nd halving | 9 Jul. 2016 | 420,000 | 12.5 BTC |

| 3rd halving | 11 May 2020 | 630,000 | 6.25 BTC |

| 4th halving | ~16 Apr. 2024 | 740,000 | 3.125 BTC |

| 5th halving | Expected 2028 | 8500,000 | 1.5625 BTC |

| Maximum supply reached | Expected 2140 | 6,930,000 | 0 BTC |

The halving event in Bitcoin refers to a 50% decrease in the reward for mining blocks, which means miners obtain fewer Bitcoins for each transaction they verify. The halving continues until all 21 million Bitcoins have been released into circulation. It ensures a measured distribution of Bitcoin, underlining its scarcity and potentially prompting a surge in prices.

To date, three halving events have taken place in 2012, 2016, and 2020. These events have historically been followed by significant market rallies and new record highs in the subsequent year, which is often attributed to increased demand, more limited supply, and speculative behavior.

More halving events are expected before the last Bitcoin block is mined around 2140. As we approach each halving, the associated market volatility could heighten.

The halving events in Bitcoin are integral to its economic framework and have a substantial impact on its value and the broader crypto market. As the Bitcoin ecosystem continues to mature, comprehending these dynamics can yield valuable foresight into Bitcoin's long-term potential.

Subscribe to our newsletter and follow us on Twitter.

Everything you need to know about Blockchain, Artificial Intelligence, Web3 and Finance.