SEC Demands $5 Billion From Terraform Labs Following Fraud Verdict

The SEC has targeted collapsed cryptocurrency company Terraform Labs and its co-founder Do Kwon with a demand for fines exceeding

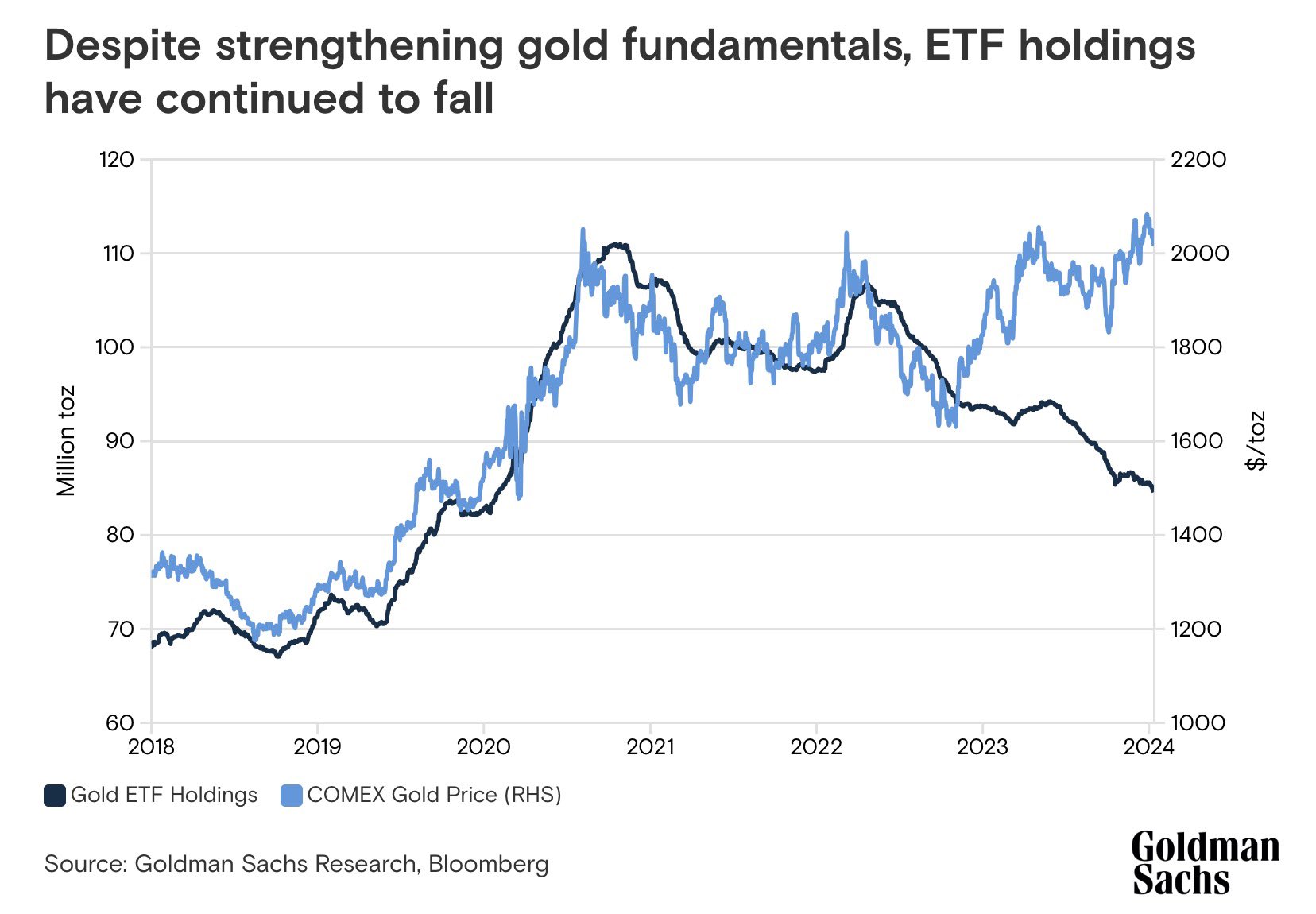

As Bitcoin takes center stage, gold ETFs are seeing significant outflows.

Bitcoin has been described as "digital gold" for years. In some ways, it's a good analogy, since bitcoin and physical gold do share important characteristics (including scarcity of supply). In others, it's a poor comparison: As a digital entity, Bitcoin is utterly and qualitatively different to gold, whereas the "digital gold" label paints it as being merely quantitatively better.

Nonetheless, it's a slogan that has stuck, and with ETF approval, bitcoin finally has the chance to compete with gold on its own terms. Although it's still early days, there are some signs that bitcoin is taking market share from gold (much to the consternation of gold bugs like Peter Schiff). Let's look at some figures.

In the short term, price is a poor indicator of success, since the markets are full of noise. (Over the long run, of course, it's the only indicator that matters.)

Nonetheless, the macro backdrop is the same for both gold and bitcoin. Since the ETFs were approved and launched on January 11, bitcoin has risen almost 11%, from $46,000 to $51,000, though it has been a volatile ride.

Gold, meanwhile, has pretty well flatlined, rising just $4 from $2,029 to $2,033.

Over any longer timeframe, bitcoin destroys gold's performance. Gold has barely put in a 2x since Bitcoin's launch.

Arguably a more important metric at this point is flows. We'll focus on the ETFs here, since they're the market where gold and bitcoin compete on similar terms. Right now, it's not looking good for gold.

Gold ETFs have had a rough start to 2024.

— Lark Davis (@TheCryptoLark) February 20, 2024

Only 3 out of the 14 gold ETFs have seen inflows.

The most significant outflows come from BlackRock and iShares gold ETFs, with $230M and $423M leaving, respectively.

Looks like BlackRock's gold bugs are fleeing to Bitcoin. pic.twitter.com/EMtXRwPDlV

This is part of a wider picture of decline since late 2020. While gold price put in a number of local tops just above $2,000 and finally broke through (only to pull back again), a huge amount of money has flooded out of gold ETFs over the last three years. From a peak of over 110 million Troy oz,they have declined to around 85 million troz: A fall of almost a quarter.

If the long-term picture is bad for gold ETFs, the short-term one is terrible.

Can someone do a wellness check on @PeterSchiff? pic.twitter.com/mUc2xGwK2j

— Jameson Lopp (@lopp) February 14, 2024

As far as the total value ("market cap") of gold and bitcoin go, gold is still way ahead. Bitcoin's market cap is around $1 trillion, while gold's is roughly $13 trillion.

That picture is not replicated for the ETFs, though, which have emerged as one of the most liquid and active ways of trading both assets. Overall, the bitcoin ETFs have over $37 billion under management. Gold ETFs stand around $93 billion.

In less than 30 trading days, Bitcoin Spot ETFs are narrowing the asset gap with Gold Spot ETFs.

— Binance VIP & Institutional (@BinanceVIP) February 23, 2024

BTC ETFs stand at $37B, while Gold ETFs are at $93B. pic.twitter.com/8rKR0DB46N

To say this happened in the last few weeks is not quite accurate, since GBTC had already existed for years, before being converted to an ETF. Nonetheless, with the ETFs currently adding thousand of bitcoins, worth hundreds of millions of dollars, every trading day, the trajectory for both assets is clear.

2024 may very well be the year that Bitcoin begins to rival gold as a store of value and global safe have asset.

Subscribe to our newsletter and follow us on X/Twitter.

Everything you need to know about Blockchain, Artificial Intelligence, Web3 and Finance.